Insights

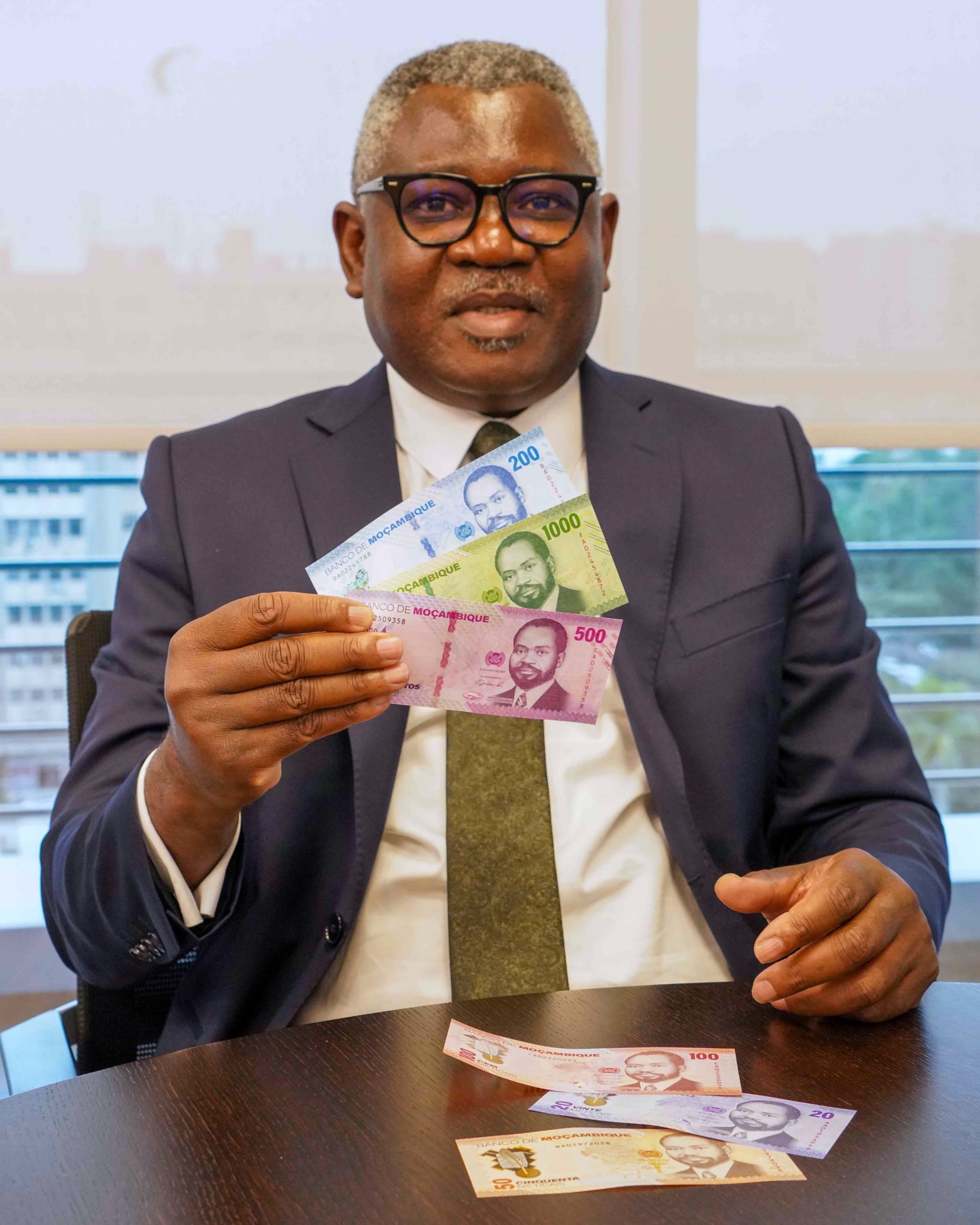

The Story Behind the New Metical Banknotes in Mozambique

Banco de Moçambique is the latest example of a new modernization trend in the industry. Central banks increasingly upgrade their banknotes by incorporating the latest banknote security technology while keeping the current designs relatively unchanged. This leverages the public’s familiarity with primary imagery, colors, and dimensions – while modern customized security features add new effects that breathe new life into the well-known banknotes and ensure security for decades.

Issuing new banknotes in Mozambique is treated confidentially until launch – but within just a few days, the introduction video saw over 200,000 views, striking a balance between secrecy and public engagement.

After the successful launch, Mr. Juvane sat down with Crane Currency to respond to our questions:

What were the main reasons for the upgrade?

In 2019, the Currency Department completed a performance analysis of Metical banknotes and coins. It assessed the design and security of the notes originating from 2011, including their durability.

The study concluded that Metical banknotes perform well, with the only need to increase the security of our banknotes to prevent and stay ahead of counterfeiting, both in terms of machine-readable and visual security features.

Modernize versus entirely new?

The design concept takes into consideration the old series of Metical banknotes. In the tender document a proposal for a key design aspect was made and is contained in the 100 MT denomination. It shows on the reverse a straw or “Tonga” basket commonly used across the country.

On the front of the 100 MT banknote is a tree from which straws are used for making baskets. From these simple elements, a strong theme for the new series emerged connecting all individual denominations into a single family, telling stories that are lasting, relatable and easy to visualize.

The video introducing the new series saw over 200,000 views within a few days of the Bank’s announcement. Were you surprised by how many views it had?

Yes, considering that the video introduction was a new experience for the Bank, this number exceeded our expectations, having reached the peak in terms of audience. In our communication strategy, we wanted to inform about the Series 2024 through all means to reach the largest number of people possible.

We wanted all Mozambicans to know about the new Metical banknotes within three months of its introduction. With this strong interest registered via the video views, we feel we are advancing well towards achieving that goal.

How important is public engagement for the Bank? What was your launch strategy for the new notes?

The most important part of the Series 2024 launch strategy was to ensure continued public confidence in the Metical, our official currency. The communication plan was designed so that all social classes, regardless of where they are located, are aware of the new banknote series. We then used an array of communication channels, e.g. a mobile app, Facebook, Twitter (X), YouTube as well as national TV and radio channels.

Among the various pieces of information disseminated by the Bank, the key message refers to the characteristics of the new banknote series, especially aspects related to their design, which focus on their Mozambican identity.

The plan also included sharing knowledge of the security features using the Touch, Observe and Tilt methodology. It is the Bank's intention that everyone shall know at least two to three security features very well.

In terms of circulation, the Bank announced that the current series would circulate simultaneously with the previous series, those of 2017, 2011 and 2006. Co-circulation is important both in terms of costs for the Bank and in terms of maintaining public confidence in the Metical.

And how did you balance the need for secrecy with public engagement and publicity?

In Mozambique the issuing of a new series of banknotes is treated confidentially and secrecy was embedded in all our strategies. But we had to balance the confidentiality with the need to inform the entire population of the upgraded banknotes and the new security features.

Internally, that meant breaking traditional ways of working related to the secret printing of banknotes, adopting a model of openness and high-level of trust. Crane Currency are experts, and they had to get access to all material previously treated as confidential by the Bank.

The mandate was given directly from the Governor, and I enforced that we followed the program. The final launch went very well due to the strategic communication plan we established, the strong engagement internally at the Bank and our partnering and external collaboration model.

How have the public and businesses reacted to the new notes?

The confidentiality when issuing a new series of banknotes meant that we didn’t get the public’s first reaction until after the announcement by the Governor on May 17, informing about the new Metical notes and coins being issued on June 16, 2024. This information came as a surprise to the public, and speculations about the design of the banknotes immediately arose.

On Friday, June 14, commercial banks collected funds in new banknotes at all Bank of Mozambique branches. On the following day there were circulating on WhatsApp images of bundles of the new banknotes. These were tied to a single commercial bank, which formally apologized for the lapse. On Saturday June 15 at noon, the new currency was made public.

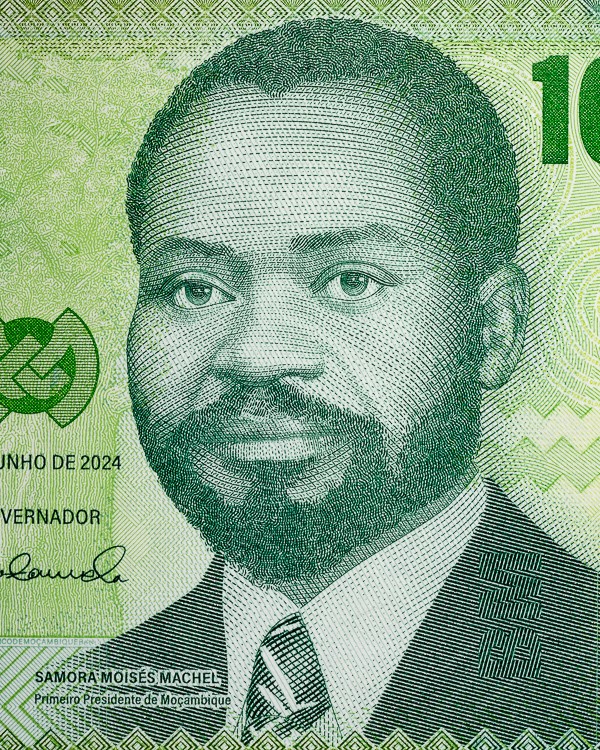

The new notes then began to circulate and the initial comments were very positive, favorably comparing the banknotes to those of the South African Rand, the euro, Malawian Kwacha and the enlarged portrait of President Samora.

How about on social media? What have you seen?

There have been many comments of course, some more memorable than others. One of these that received many likes concerns the image on the back of the new 200 MT. Some were interpreting that the male lion was leaving his wife and the pride, as on the previous series, he was lying with the cubs and the female lion stood at a distance. Other comments on social media were more focused on the many design elements on the notes that identify our country.

What has surprised you most during this process?

This has been a project that I will never forget, especially the strong engagement from colleagues within the Bank. The project team consists of a handful of people whom I have trained internally in various areas, including banknote security features.

The involvement from both the team and the suppliers made it possible to send educational material, posters, leaflets and other material in time to each province.

Can you explain how the Central Bank of Norway (Norges Bank) assisted with this project?

At the request of Banco de Moçambique, a Monetary and Capital Markets Department Technical Assistance mission from International Monetary Fund began assisting and advising the Bank on currency management in 2018. That mission is part of the Norwegian-funded, multi-year, central bank modernization program.

The overall objective of this holistic program is to build enhanced capacities and support modernization efforts towards a professional and efficient institution and central bank operations based on best practices.

A central objective was to increase the responsibility of developing a new banknote series. We received key points from the Central Bank of Norway on launching a new series of banknotes and coins, mainly around the regulation for tendering processes that clearly define the division of responsibilities between Banco de Moçambique and the bidders.

The Bank maintains a database of companies supplying relevant materials such as inks, security features, substrates and printing for banknote production. With this information in hand, we sent requests in May 2021 asking which security features and substrate they would recommend for our banknotes. We then received very good suggestions that were considered in our tendering process.

The Bank reduced the number of suppliers for its banknotes and coins. How has this impacted the procurement process?

It is important to mention that the Bank received input from several companies expressing interest in participating in the Tender, both for banknotes and coins. The only difference was that in the end, the Bank selected a single supplier for each banknote and coin production to guarantee that all of them, respectively, have the same characteristics.

We used a two-stage process in which it solicited the suppliers’ availability through a prequestionnaire with those responses assessed accordingly. Those who satisfactorily fulfilled the pre-conditions received the tendering documents.

The tender included specific terms, contract proposal, and relevant information including price per volume, delivery and payment schedules, substrate requirements, printing tolerances, design descriptions, packaging, quality control procedures, destruction procedures of the waste materials, security requirements, etc.

Finally, what is your key advice to other central banks in a similar situation?

Among others, they would have to consider the following:

-

Set objectives and priorities by creating a project plan

-

Assess the current situation, especially regarding performance and public acceptance of banknotes

-

Analyze the international and regional context, e.g. trends followed by neighboring countries

-

Know the new products developed in the industries, especially in terms of substrates and security features are fully tested and ready

-

Get to know the potential suppliers

-

Establish clear communication with key stakeholders

-

Set a period considerably sufficient to carry the process smoothly